Fascination About Trading Indicator

Table of ContentsExcitement About Trading IndicatorSome Known Incorrect Statements About Trading Indicator 10 Simple Techniques For Trading IndicatorThe smart Trick of Trading Indicator That Nobody is Talking AboutWhat Does Trading Indicator Mean?8 Simple Techniques For Trading Indicator

Indicators are stats made use of to measure existing conditions as well as to anticipate monetary or economic patterns. Usual technical signs include moving averages, relocating average convergence aberration (MACD), relative toughness index (RSI), as well as on-balance-volume (OBV).They include the Customer Rate Index (CPI), Gdp (GDP), as well as unemployment figures. Indicators are statistics made use of to measure present problems as well as to anticipate monetary or economic patterns. Financial indications are statistical metrics utilized to determine the development or tightening of the economic situation as an entire or industries within the economic situation.

The index is a closely seen barometer of financial activity. The U.S. Division of Business uses ISM information in its examination of the economic climate. For the majority of the 21st century, housing as well as actual estate have actually been leading economic signs (TRADING INDICATOR). There are numerous metrics used to determine housing development including the S&P/ Case-Shiller Index, which measures house sale prices, and also the NAHB/Wells Fargo Real Estate Market Index, which is a survey of house contractors that measures the marketplace cravings for brand-new residences.

The 5-Minute Rule for Trading Indicator

Utilizing tools like the MACD and also the RSI, technical traders will assess properties' cost graphes looking for patterns that will certainly suggest when to buy or market the property under consideration.

Facts About Trading Indicator Uncovered

Indicator-based trading is used by brand-new traders to find fads in the market based on aesthetic indications. Usage signs with care, and also technique with a trading simulator, especially if you are a brand-new trader.

Making use of indications is called "technical analysis," because it makes use of technical instruments rather than basics like annual report ratios. As an example, one popular indication is the simple relocating average, which is used to suggest the instructions of a fad as well as disregard the price spikes that can occur in the short term.

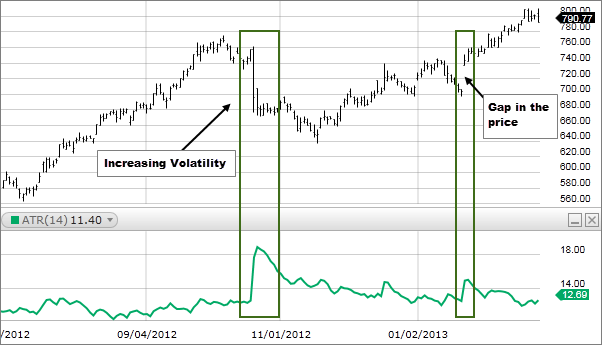

The sign reveals a visual depiction of the mathematical formula and cost inputs. Indicators give you an aesthetic idea as to just how prices are moving.

The Ultimate Guide To Trading Indicator

The majority of platforms enable you to choose the type of graph you like as well as visit the site offer numerous signs. The trading system after that instantly does the mathematics to display whichever indications you have actually picked. In the chart below, you can see the lengthy price decrease in Apple (AAPL) that began in very early April.

A trader would certainly have seen this indication a couple of weeks into April and would have begun investigating the scenarios bordering the decrease. Once they fit with the information that sustained the relocating average, they would certainly make professions based upon whichever overview they had for the stock. Trading, Sight There are lots of indications that traders can utilize.

Here are a few of the indicators that investors utilize besides moving standards: Relocating typical convergence and also aberration (MACD)Loved one strength indicator (RSI)Bollinger bands, Cost volume pattern, Fibonacci retracement Indicator-based trading varies from pattern-based trading, where traders make relocations based on recognized chart patterns. There are countless indicators, and brand-new ones are being created frequently.

The 20-Second Trick For Trading Indicator

A price or an indicator can go across paths with an additional sign. An alternate version of the price-crossover strategy takes place when a shorter-term relocating ordinary crosses a longer-term moving standard. Crossovers occur in many signs.

Signal indicators are generally a relocating average, but they are not made use of as an indicator in these approaches. Rather, they are made use of with other indications to produce trading signals. Other crossover signals include a family member stamina sign (RSI) moving above 70 or 80 and then back below, indicating an overbought condition that may be drawing back.

Indicators are exceptional devices for finding out exactly how to detect weakness or toughness in the why not find out more price, such as when a fad is weakening., yet with the help of some signs, they are made mindful of subtle adjustments they have not yet educated themselves to see on the rate chart.

10 Simple Techniques For Trading Indicator

Indicators just show what rates have done, not what they are mosting likely to do. A relocating average could maintain trending down, but that does not assure that it will certainly continue this way. A trader who comprehends how and what a candle holder or bar chart is informing them click for more info doesn't get anymore information from those charts by adding indicators - TRADING INDICATOR.

Each trader has to locate signs that help them as well as create an earnings. Lots of techniques do not create a revenue, despite the fact that they are preferred and also well known. Indicators must be made use of with care, and also you must exercise trading them by using training software application before venturing into the market and also utilizing your money.